Powering SmarterFinancial Engagement

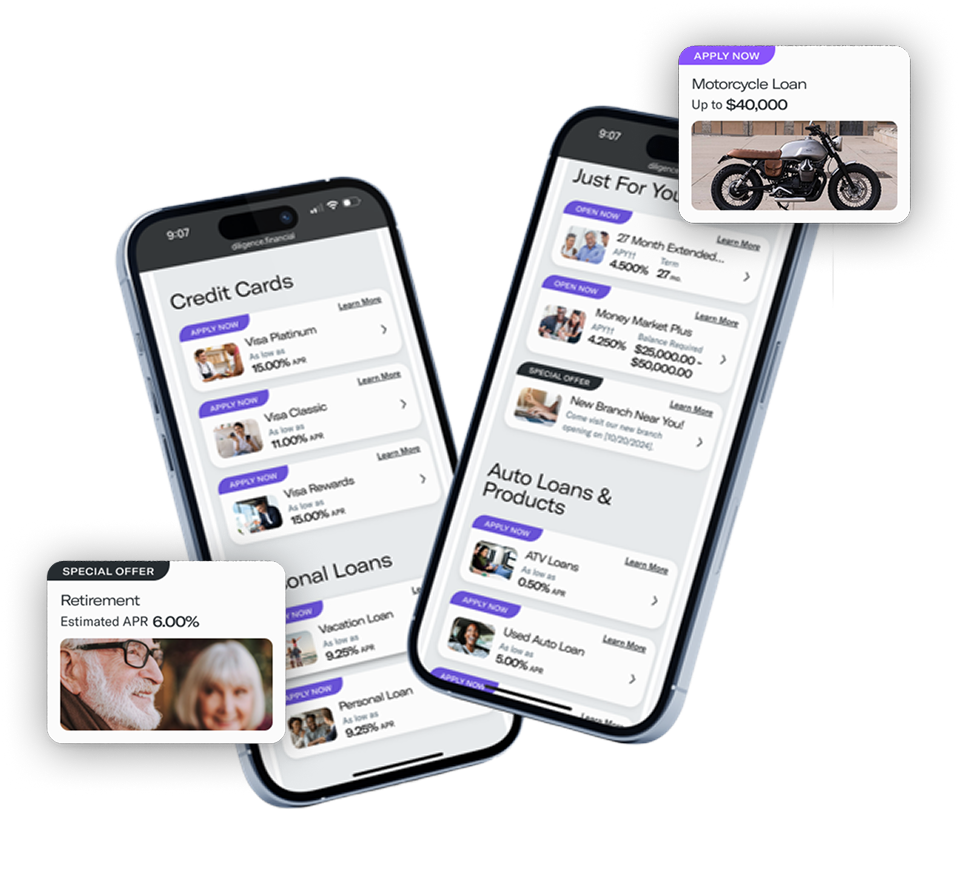

Movemint is a digital marketing and embedded finance platform that enables financial institutions to drive loans, deposits, and non-interest income growth through personalized, efficient data-driven experiences.

What is Movemint?

Embedded where it matters. Reusable everywhere. Built to grow products per member.

Movemint’s embedded engagement platform delivers relevant lending, deposit, and service offers to existing, prospective, and indirect consumers natively within online and mobile banking and easily extends across branch, contact center, and marketing channels. Offers and pricing are personalized using institution-defined consumer attributes, giving financial institutions full control over relevance, strategy, and growth.

Embed

Target

Engage

Convert

Optimize

Integrations

Why Movemint?

Built for Financial Institutions

Movemint helps you move beyond static marketing and toward dynamic, member-centric growth.

- Native digital banking integration

- Policy-driven, compliant personalization

- Fully branded member experiences

- Data-powered automation

- Measurable performance insights

Movemint

Customer Success Stories

Over $194M in

loans funded over 11 months

A credit union with over 500K

members displayed Movemint

offers to a subset of their members for 11 months.

Offers redeemed by members included:

- $182.7M in consumer loans (auto, personal, and credit cards)

- $12.1M in home equity loans

- $26.8M in CDs

- $340K in high-yield savings

- $200K in checking

- $154K in GAP income

$23.9M in loans requested in 60 days

A credit union with over 100K members offered loans to a subset of their members through Movemint for 60 days.

Loan offers:

- 31,903 preapproved offers

- 411 accepted

- $8.2M in loan offers redeemed

- 55,178 consumer loan applications offered

- 1,240 applications received

- $15.7M in loans requested

Total results:

- $23.9M in loans requested

by members

$55.8M in loans requested in 90 days

A credit union with over 100K members offered loans to a subset of their members through Movemint for 90 days.

Pre-approved loans:

- 36,740 offers with 1,735

accepted (4.7% acceptance rate) - $36.8M in loan offers accepted

Consumer loan applications:

- 42,966 offers with 1,149 accepted (2.7% acceptance rate)

- $19M in loans requested

Total results:

- $55.8M in loans requested

$17.2M in loans funded in 90 days

A credit union with over 100K members offered loans to a subset of their members through Movemint for 90 days

Pre-approved loans:

- 38,491 pre-approved offers

- 991 accepted by members

Consumer loan applications:

- 31,715 invitations to apply

- 415 accepted by members

Total results:

- $17.1M in pre-approved loans funded

Grow with Movemint

See What Happens When Relevance Meets Scale

Movemint gives financial institutions the infrastructure to turn personalized engagement into measurable growth–across every channel.

Move smarter. Move faster. Move with Movemint.